Prepare ahead for the e-invoicing mandate by making sure your business meets all the required criteria. If you have any questions about e-invoicing, reach out to us, and we’ll get back to you within a day.

An e-invoice is a digital invoice that companies use to send, receive, and manage invoices electronically. By using e-invoicing, businesses can automate manual processes and improve efficiency. This reduces errors and makes it easier for businesses to follow e-invoicing rules set by governments or other organizations.

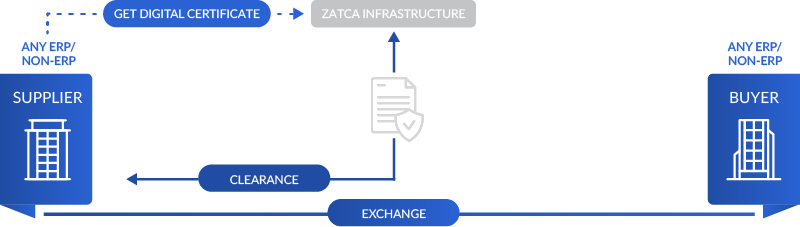

Starting December 4, 2021, the Zakat, Tax, and Customs Authority (ZATCA) requires all businesses in Saudi Arabia to use electronic invoicing (e-invoicing). Paper or PDF invoices will no longer be allowed. The e-invoicing system will have two main phases. Businesses need to prepare for different situations, such as the possible need to get approval for each invoice or transaction.

FATOORAH, the electronic invoicing system, is required for taxpayers living in Saudi Arabia. It also applies to customers or third parties issuing tax invoices on behalf of Saudi Arabian taxpayers, as outlined in the VAT Implementing Regulation.

The new regulation applies to: * Businesses (B2B) that transact in Saudi Arabia * Saudi residents who are liable to pay VAT * Third parties who create invoices for VAT-registered taxpayers This regulation does not apply to non-resident companies.

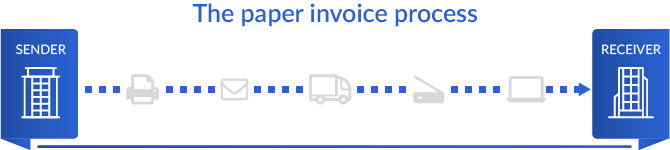

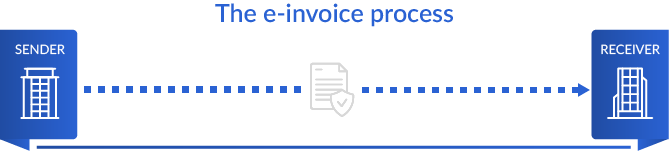

An e-invoice involves the digital creation, transmission, receipt, and handling of invoices. It provides an end-to-end solution that allows automatic invoice exchange between company Enterprise Resource Planning (ERP) systems, eliminating manual processes.

-Manual handling – material costs – delivery costs -print – create invoice – archive – manual handling – validation – verification – authorisation – matching – errors – slow delivery – time consuing – involve workers

+Traceable delivery + error free + fastest process + operational savings + increased financial control

Within, you will discover fascinating insights, professional viewpoints, a timeline, and numerous helpful tips.

Our software meets Saudi Arabian regulations for e-invoices, including requirements for format, data, e-signatures, reporting, and approvals. Infinite e-Invoicing is a top-notch and accessible platform that makes all accounts payable/accounts receivable invoicing processes automatic, regardless of the size or technological abilities of your company.

Our solution has been meticulously designed to address the complexities of the digital era. It adheres meticulously to the most recent regulations governing data interchange and conforms to cutting-edge data transfer standards.

This software solution features cutting-edge capabilities like self-billing, electronic archiving, digital signatures, data validation, format conversions, and multi-channel distribution. These tools enhance data management efficiency and tailor the solution to your unique needs.

Fast and protected data sharing

Streamlined payment handling

Reduced costs

Reduced human mistake

Fewer incomplete or inaccurate documents

Lower ongoing costs

Payments made on time

Supports sustainability goals

Improved cash flow management

Faster processing

Dedicated customer support

Effortless implementation

Fill out the form below to download the Free E-Book

We provide a full spectrum of IT services from software design, development, implementation and testing, to support and maintenance.

Concord Tower - 10th Floor - Dubai Media City - Dubai - United Arab Emirates

(UAE) Tel: +97143842700

Building 14, Street 257, Maadi, 8th floor

(Egypt)Tel: +2 010 2599 9225

+2 022 516 6595

Email: info@singleclic.com