Introduction

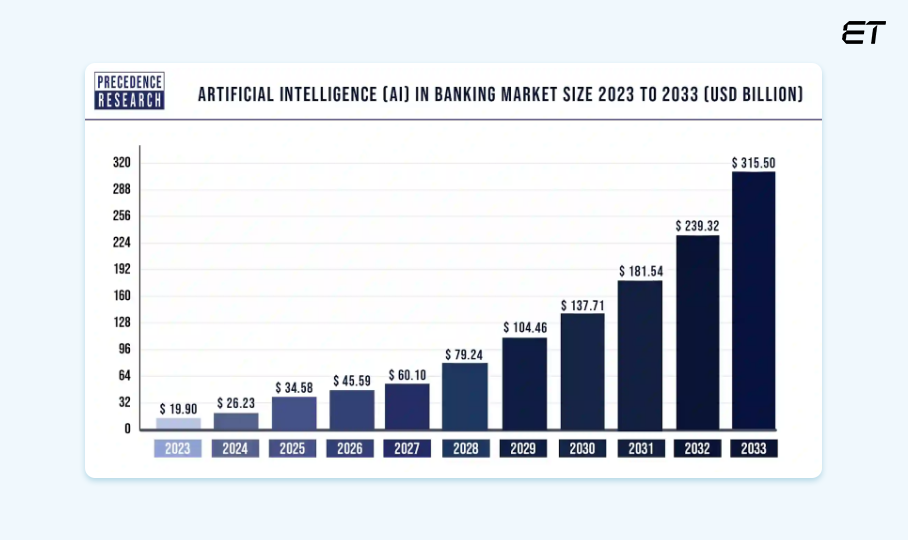

Financial Machine Learning (FML) is transforming how investors, hedge funds, and financial institutions make data-driven decisions. By leveraging advanced algorithms, machine learning models can analyze complex datasets, identify patterns, and predict market movements with unprecedented accuracy.

But is FML the future of finance, or is it just another trend? This article explores the potential, challenges, and real-world applications of financial machine learning, offering a comprehensive, SEO-optimized guide to this evolving field.

What is Financial Machine Learning?

Financial Machine Learning refers to the use of artificial intelligence (AI) and machine learning techniques to analyze financial data, detect patterns, and make investment decisions. Unlike traditional statistical models, ML algorithms can:

- Process massive datasets in real-time.

- Adapt to new data trends.

- Identify non-linear relationships in financial markets.

Key Technologies in Financial Machine Learning

Financial Machine Learning utilizes several key technologies, including:

Neural Networks

- Used in deep learning models to detect complex financial trends.

- Applied in high-frequency trading and credit scoring.

Natural Language Processing (NLP)

- Helps analyze news sentiment, social media trends, and earnings call transcripts.

- Used by hedge funds to predict stock movements.

Reinforcement Learning

- Optimizes trading strategies through reward-based learning.

- Applied in algorithmic trading systems.

Why Financial Institutions are Investing in Machine Learning

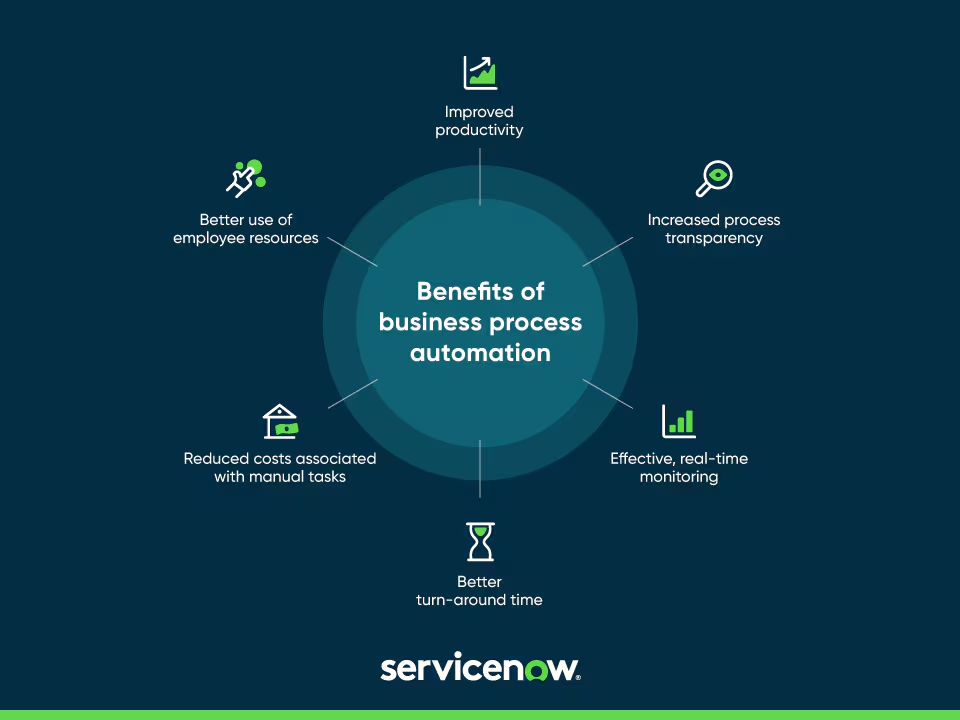

Financial organizations invest in ML because of its ability to increase efficiency, reduce risk, and enhance decision-making. Some of the key benefits include:

Enhanced Risk Management

- Identifies credit risks and fraudulent transactions in real-time.

- Automates fraud detection through anomaly detection algorithms.

Automated Trading Strategies

- Algorithmic trading models execute trades at optimal times.

- Hedge funds use ML-driven quant strategies to minimize human bias.

Portfolio Optimization

- ML algorithms analyze diversification strategies for better asset allocation.

- Predictive analytics helps minimize downside risks.

People Are Always Asking…

Is Financial Machine Learning Better Than Traditional Investment Strategies?

Many investors wonder if machine learning outperforms traditional investment methods. Tamer Badr, founder of Singleclic, believes that “machine learning does not replace human intuition but rather enhances it. Financial professionals must still interpret results and align them with macroeconomic trends.”

How Accurate is AI in Predicting Stock Prices?

AI models improve prediction accuracy but cannot guarantee success. Market volatility, geopolitical events, and black swan events still introduce uncertainty.

What Are the Best Programming Languages for Financial Machine Learning?

- Python – Popular for its ML libraries like TensorFlow, Scikit-learn, and Pandas.

- R – Used for statistical computing and financial modeling.

- C++ – Favored for high-frequency trading due to its execution speed.

Top Financial Machine Learning Tools & Platforms

1. TensorFlow & Keras

- Pros: Open-source, widely used for deep learning.

- Cons: Steep learning curve for beginners.

2. Scikit-learn

- Pros: Simple for beginners, great for classical ML models.

- Cons: Limited for deep learning applications.

3. Bloomberg Terminal AI Integration

- Pros: Access to real-time market data and AI-powered analytics.

- Cons: Expensive for individual investors.

Potential Drawbacks of Financial Machine Learning

While the benefits are significant, it’s essential to address potential challenges:

Data Bias & Overfitting

- ML models trained on biased historical data can lead to inaccurate predictions.

High Computational Costs

- Running complex AI models requires expensive GPU clusters and cloud infrastructure.

Regulatory & Ethical Concerns

- Financial regulators scrutinize algorithmic trading to prevent market manipulation.

How to Get Started in Financial Machine Learning

Step 1: Learn Python and ML Basics

- Enroll in courses like Coursera’s “Machine Learning for Finance.”

- Master Pandas, NumPy, and Scikit-learn.

Step 2: Explore Financial Datasets

- Start with Yahoo Finance API or Quandl.

- Analyze historical price data and trading volumes.

Step 3: Build and Backtest ML Models

- Develop regression models to predict stock returns.

- Use QuantConnect or Zipline for backtesting strategies.

Future of Financial Machine Learning

Experts predict that AI-driven finance will continue evolving. Tamer Badr emphasizes, “As ML models become more sophisticated, we must ensure they remain interpretable and aligned with investor goals.” Expect innovations in:

- Explainable AI (XAI) for transparent financial decisions.

- Quantum computing for ultra-fast market predictions.

- Decentralized finance (DeFi) powered by AI analytics.

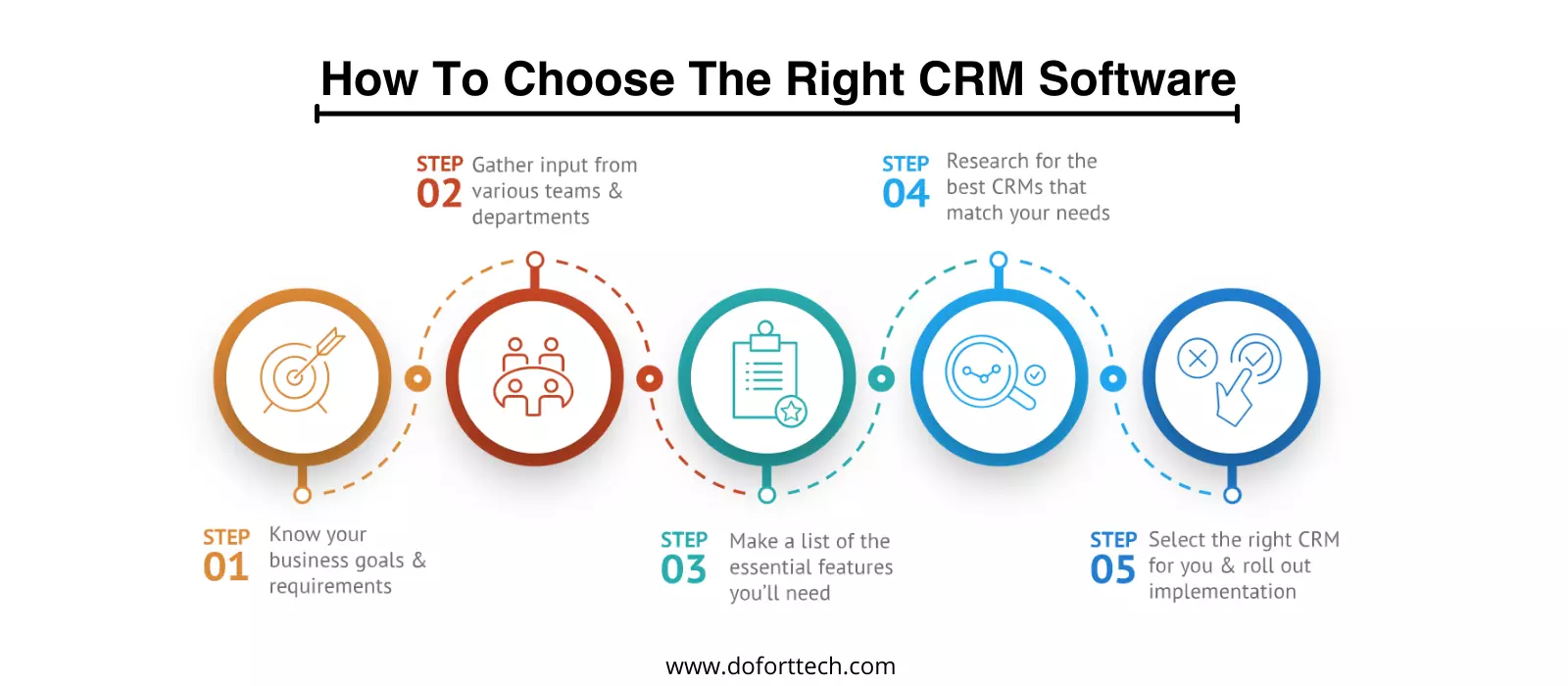

To fully harness the potential of financial machine learning, businesses can integrate it with various automation and analytics solutions. For instance, leveraging Business Process Automation Services can enhance efficiency by streamlining repetitive financial tasks. Additionally, Data Analytics Services play a crucial role in extracting actionable insights from vast financial datasets, enabling better decision-making. Companies utilizing Microsoft Dynamics 365 can further enhance their ERP and CRM capabilities by integrating machine learning models for predictive analytics. Meanwhile, adopting Low Code Development enables organizations to quickly deploy machine-learning-powered financial applications with minimal coding expertise. Moreover, implementing financial machine learning within a well-structured ERP Framework ensures seamless operations and data-driven decision-making. By connecting these technological solutions, businesses can unlock new efficiencies and competitive advantages in the financial sector.

FAQs

Q: Can AI Replace Financial Analysts?

A: No, AI enhances financial analysis but cannot replace human expertise in macroeconomic trends and investor psychology.

Q: Are ML-Driven Trading Strategies Risk-Free?

A: No, even the best ML models cannot predict black swan events or extreme market crashes.

Q: What is the Best ML Algorithm for Stock Market Prediction?

A: It depends on the use case. Random forests and gradient boosting work well for classification problems, while LSTMs excel at time-series forecasting.

Reviews from Financial Experts

- “ML-driven portfolio optimization improved our risk-adjusted returns by 15% in a year.” – Investment Analyst, Hedge Fund

- “The biggest challenge is data quality. Garbage in, garbage out still applies.” – Data Scientist, Wall Street Firm

- “Regulatory compliance is our top concern when deploying AI in finance.” – CTO, FinTech Startup

Conclusion

Financial Machine Learning is reshaping investment strategies, offering unparalleled insights and automation. While challenges exist, ML empowers financial professionals to make smarter, data-driven decisions. As AI continues to evolve, staying updated with the latest trends and ethical considerations will be crucial for success.