Introduction:

In today’s banking market, digital transformation is a must for standing out. Banks today require automation to ensure regulatory compliance, enhance customer experiences, and streamline operations. Leading this movement is IBM’s Business Process Management (BPM) software. Banks that work with Singleclic, a leading digital transformation company, can use IBM’s BPM to streamline their operations. Let’s examine the top five procedures that banks need to use IBM BPM to automate and discover how Singleclic can help them along this innovative path.

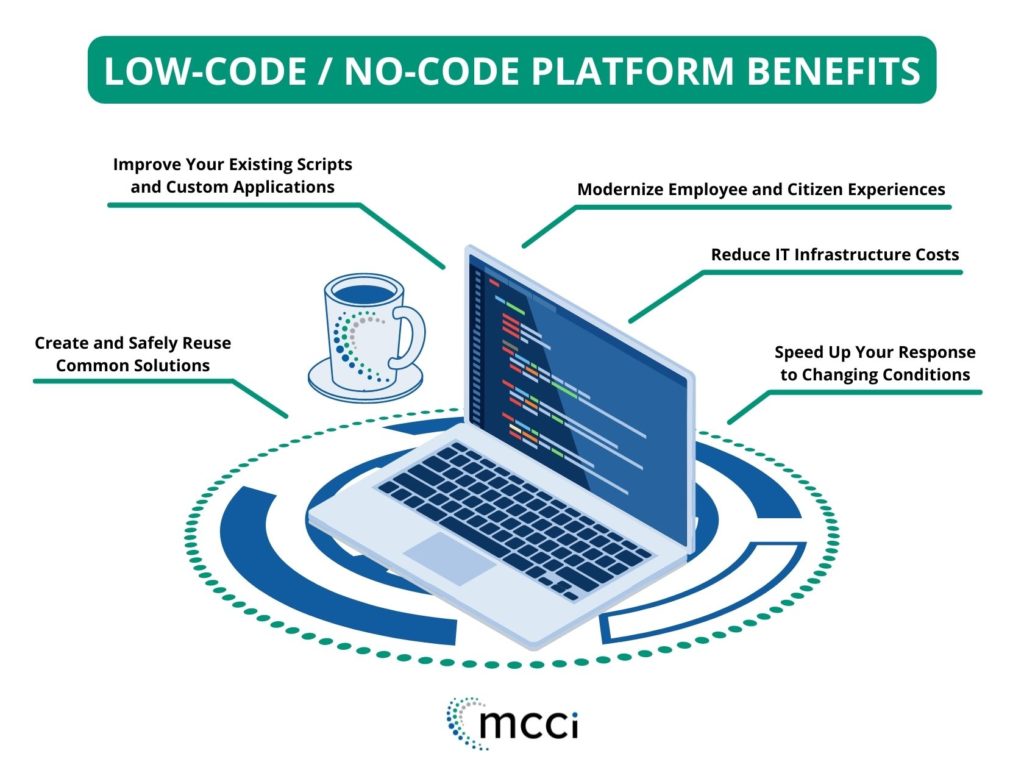

Potential Benefits of Automation: Using IBM’s BPM to automate important banking procedures has benefits beyond increased productivity. Reducing human labor and operational overhead is the way to save costs. However automation improves accuracy and consistency by lowering human error whilst maintaining data integrity, as well as adhering to legal requirements. Simplifying processes frees up valuable resources, allowing bank employees to focus on customer relationship management and strategy development. Additionally, automation fosters creativity and agility by allowing banks to respond quickly to changing customer needs and market dynamics. Ultimately, banks that adopt automation through IBM’s BPM become industry leaders, surpassing competitors and boosting profits.

Process 1: Account Opening (Duration: 45 days)

Traditionally, opening an account involved a lot of paperwork and manual verification. This would take weeks. With IBM’s BPM, banks can cut this process down to just 45 days. By automating account verification, document management, and electronic signatures, banks can speed up customer onboarding while ensuring compliance. Singleclic’s expertise in digital transformation ensures smooth integration of IBM’s BPM, empowering banks to streamline account opening procedures and enhance customer experience. Automating the account opening process with IBM’s BPM can yield substantial ROI through reduced processing times and improved customer satisfaction, leading to increased account acquisitions and revenue generation.

Process 2: Customer Onboarding (Duration: 50 days)

Effective customer onboarding is essential to fostering long-lasting bonds and increasing loyalty. Errors and delays are frequent outcomes of manual operations. Workflows for onboarding are automated by IBM’s BPM, cutting down on time from months to just 50 days. With IBM’s BPM, the onboarding process is streamlined from identity verification to product introductions, guaranteeing data quality and compliance. With the assistance of Singleclic, banks may put customized plans into place to streamline customer onboarding and raise retention and satisfaction levels. By expediting time-to-revenue, decreasing errors, and optimizing procedures, automation for client onboarding can yield substantial return on investment. This ultimately results in increased customer lifetime value and retention.

Process 3: Loan Origination (Duration: 30 days)

In order to satisfy consumer demands and control risk, banks must operate efficiently while originating loans. With the help of enhanced automation provided by IBM’s BPM, the loan origination process can be streamlined and shortened from many months to just 90 days. IBM’s BPM can evaluate borrower eligibility, evaluate creditworthiness, and speed approval decisions by utilizing analytics and machine learning. Banks can effortlessly combine IBM’s BPM with Singleclic’s collaborative approach to digital transformation, increasing loan origination efficiency and guaranteeing compliance. By speeding up loan processing, cutting expenses for administration, and raising client satisfaction, investing in automated loan origination can yield a substantial return on investment, ultimately spurring development and profitability.

Process 4: Payment Processing (Duration: 60 days)

Timely and efficient payment processing is essential for maintaining liquidity and meeting customer expectations. IBM’s BPM automates payment processing workflows, reducing the duration from weeks to just 60 days. By streamlining internal and external transactions, IBM’s BPM accelerates fund transfers while ensuring security and compliance. With Singleclic’s guidance, banks can optimize payment processing, driving operational efficiency and enhancing the overall banking experience. Automating payment processing workflows can generate substantial ROI by optimizing operational efficiency, reducing transaction costs, and minimizing payment errors, resulting in improved cash flow and profitability.

Process 5: Customer Complaints Management (Duration: 55 days)

Handling customer complaints effectively is paramount for preserving trust and loyalty. Manual complaints management processes can result in delays and dissatisfaction. IBM’s BPM provides a centralized platform to automate complaints management, reducing the duration from months to just 55 days. IBM’s BPM automates the entire complaints management process, from tracking resolutions to logging complaints, guaranteeing prompt answers and resolutions. By leveraging Singleclic’s proficiency in digital transformation, financial institutions can improve their complaints handling capacities, cultivating more robust client connections and fidelity. By improving customer satisfaction, cutting down on resolution times, and lowering reputational risks, utilizing IBM’s BPM for automated customer complaints management can result in a substantial return on investment. This will eventually lead to long-term loyalty and revenue development.

Conclusion:

In the current digital era, automating critical banking operations with IBM’s BPM is essential for improving client experiences, increasing operational efficiency, and maintaining competitiveness. Banks can use Singleclic as a partner to take advantage of IBM BPM to transform their operations, optimize workflows, and provide better services. Using IBM’s BPM and Singleclic’s advice to embrace automation would surely put banks in a successful position in the ever-changing and competitive banking market.

To learn more about Singleclic, look here!