The banking industry is undergoing a massive transformation, driven by FinTech innovations that prioritize customer experience. Today’s customers expect convenience, speed, and personalization — and Singleclic delivers these capabilities through advanced IT solutions for banking.

Learn more about FinTech innovations in banking

What Is the Customer Experience of FinTech?

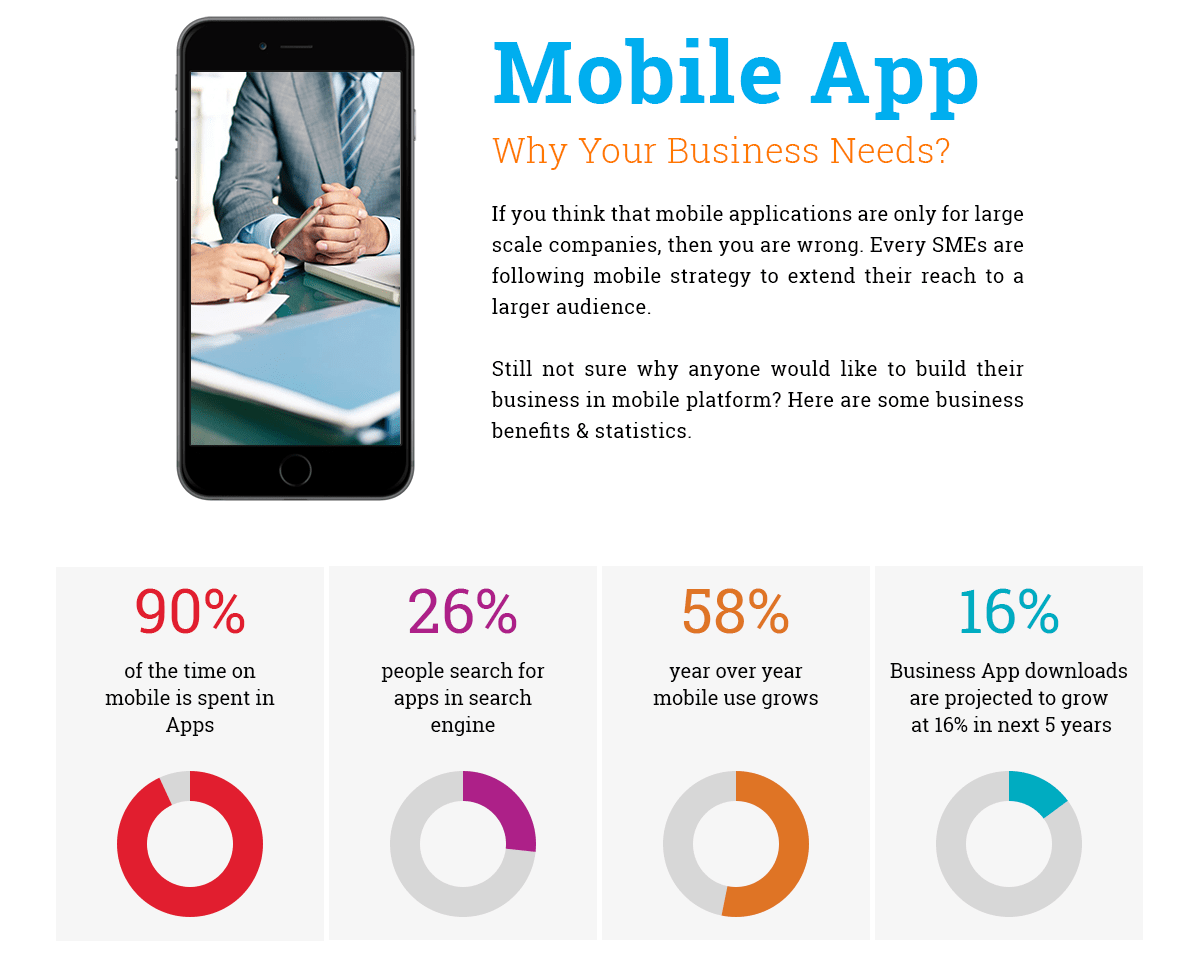

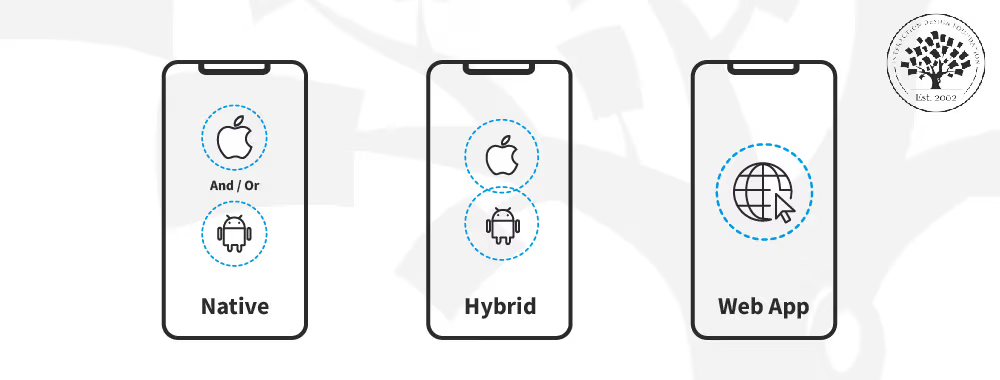

The customer experience of FinTech refers to how technology-driven solutions improve every touchpoint between banks and their customers. From seamless mobile transactions to AI-powered financial advice, FinTech ensures that customers enjoy fast, secure, and tailored banking services.

Singleclic, since 2013, has been a leading provider of custom banking solutions in the MENA region, helping banks transform their operations to meet evolving customer expectations.

How Do FinTech Services Enhance the Overall Banking Experience?

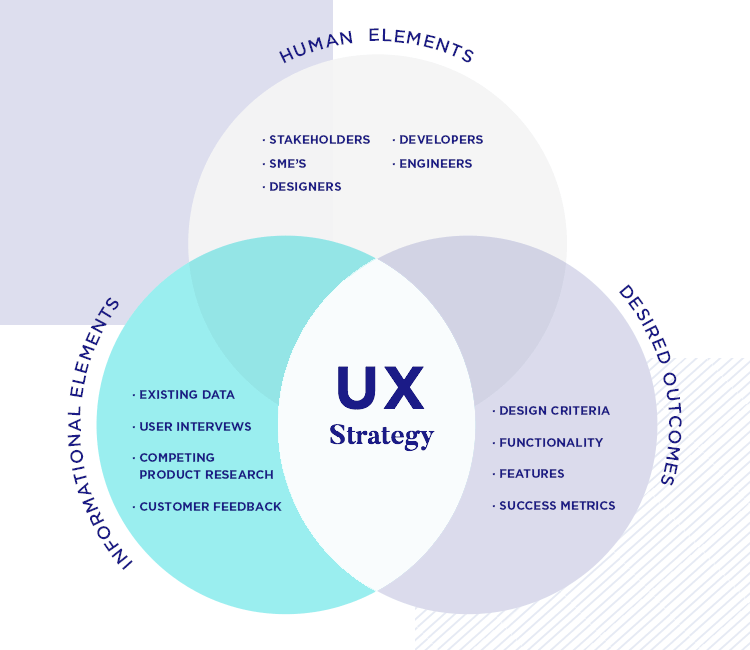

FinTech services enhance banking by focusing on four key pillars:

- Convenience – Mobile banking apps, online account opening, and instant payments.

- Security – Advanced cybersecurity measures and fraud prevention systems.

- Personalization – AI-driven insights and tailored product recommendations.

- Speed – Real-time transactions and automated processes.

1. Seamless Digital Onboarding

Banks can now onboard customers remotely in minutes, using secure ID verification and e-signatures, reducing wait times and paperwork.

2. 24/7 Digital Support

Chatbots and AI assistants provide round-the-clock banking support, allowing customers to resolve queries instantly.

3. Secure and Fast Transactions

Through blockchain and real-time payment systems, customers can transfer money quickly while maintaining top-tier security.

Which FinTech Innovations Are Impacting the Consumer Experience?

Several FinTech innovations are transforming banking in the MENA region:

- Mobile Banking Apps: Unified platforms for payments, savings, and investments.

- AI & Machine Learning: Predictive analytics for credit scoring and financial planning.

- Blockchain Technology: Enhancing transparency and reducing fraud.

- Biometric Authentication: Fingerprint and facial recognition for secure access.

Singleclic integrates these innovations with ERP, CRM, and low-code solutions to ensure banks can deploy them effectively.

How to Enhance Customer Experience in Banking with FinTech

Banks aiming to improve their customer experience can follow these strategies:

Invest in Data-Driven Insights

Leverage customer data to provide personalized banking offers and relevant financial advice.

Prioritize Mobile-First Experiences

Ensure mobile apps are intuitive, secure, and feature-rich.

Adopt Omnichannel Banking

Offer customers a consistent experience across mobile, web, and branch services.

Implement Proactive Security Measures

Use cybersecurity solutions like threat detection and AI-powered fraud prevention — areas where Singleclic excels.

Why Choose Singleclic for Your Banking Transformation?

Since 2013, Singleclic has been delivering end-to-end FinTech and IT banking solutions across the Arab world.

Our expertise covers:

- Custom Banking Software Development

- Cybersecurity Solutions

- Cloud-Based Hosting for Banking Applications

- 24/7 Technical Support

📞 Contact us today:

Egypt: +2 010 259 99225

UAE: +971 42 475421

KSA: +966 58 1106563

🌐 Visit Singleclic Website

Final Thoughts

Enhancing customer banking experience through FinTech is no longer optional — it’s essential for staying competitive. With Singleclic as your technology partner, your bank can deliver faster, safer, and more personalized services, ensuring long-term customer loyalty.