B2B invoicing is no longer a slow, paper-heavy process. It’s moving fast toward automation, real-time validation, and full compliance with digital tax systems like Saudi Arabia’s ZATCA. The shift affects how companies issue, receive, and manage their invoices across industries.

And it’s more than just going paperless. Today, businesses want error-free billing, faster payments, and systems that align with government regulations. The right B2B invoicing solution can bring all of that—if done right.

In the Middle East, Singleclic is leading the change with smart, ZATCA-compliant invoicing tools. As the region’s first mover in this area, they are helping businesses modernize their financial operations while staying fully compliant.

What Is B2B Invoicing?

B2B invoicing is the process of sending payment requests between two businesses—one being the seller or service provider, and the other the buyer. It involves more than just an invoice PDF. It requires clear data, matching tax rules, tracking, approval flows, and reconciliation.

Today’s invoicing can be:

- Manual (Excel, Word, PDF by email)

- Semi-automated (accounting software with limited integration)

- Fully digital (real-time invoice exchange and tax validation)

“Manual invoicing wastes time and opens the door to errors. With digital systems, companies save effort, avoid fines, and get paid faster,” says Tamer Badr, CEO of Singleclic.

People Are Always Asking: “Do I Really Need to Digitize My Invoicing?”

Yes. In fact, in many regions, you don’t have a choice anymore.

Governments like Saudi Arabia’s ZATCA require e-invoicing. Businesses that don’t comply face penalties.

But even without regulation, the benefits of digital B2B invoicing are too valuable to ignore:

- Fewer errors

- Faster payment cycles

- Instant tax compliance

- Improved cash flow visibility

Benefits of Modern B2B Invoicing

- Faster Processing Times

- Invoices are generated, sent, and approved in minutes.

- Reduces payment delays.

- Better Accuracy

- No need for double entry or manual data matching.

- Less room for mistakes.

- Real-Time Tax Compliance

- Complies with local regulations like ZATCA Phase 2 in Saudi Arabia.

- Prevents fines and rejections.

- Automatic Reminders

- Sends due date alerts to clients.

- Improves cash flow predictability.

- Full Audit Trails

- Every change is tracked.

- Easy to reference or report during audits.

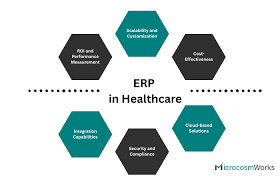

Key Features to Look For in a B2B Invoicing Tool

- E-invoice format support (e.g., XML, UBL)

- Integration with ERP or accounting tools

- Multi-currency and multi-language support

- Tax authority integration (ZATCA, FTA, etc.)

- Dashboard for tracking statuses

- Automated error validation

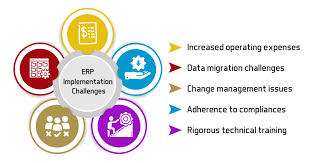

Potential Drawbacks to Watch For

While modern B2B invoicing is effective, no solution is perfect. Here are a few things to consider:

- Setup Time

Some platforms require integration and testing. Businesses need to plan the rollout carefully. - Learning Curve

Finance teams may need training to get comfortable with automation. - System Compatibility

Not all tools work with legacy ERP systems. Custom APIs may be needed. - Subscription Costs

Pricing models vary—some charge per invoice, others per user. Costs can grow as business scales.

Singleclic: Leading the Way with Smart B2B Invoicing

Singleclic offers a ZATCA-ready invoicing solution tailored to businesses in Saudi Arabia and the wider Middle East. It’s designed to automate the invoicing process while meeting local tax requirements.

“We didn’t just build a tool; we built peace of mind. Our clients stay compliant and in control without worrying about tax rule changes,” says Tamer Badr.

Explore Singleclic’s solution for ZATCA-compliant invoicing here:

👉 ZATCA Invoicing Solution

Real User Reviews

Ali M., CFO – Wholesale Distributor

“After switching to Singleclic’s invoicing platform, we reduced invoice rejections by 85%. The tax validation alone was worth it.”

Rania H., Finance Manager – Logistics Firm

“Our accounts team now closes billing in one-third of the time. No more chasing clients for minor errors.”

Hassan K., IT Director – Electronics Retailer

“Integration with our ERP was smooth. Singleclic’s team handled all custom API needs.”

Steps to Digitize Your B2B Invoicing

- Evaluate Your Current System

- Is it manual or semi-automated?

- Where do errors and delays happen?

- Understand Regulatory Requirements

- If you’re in Saudi Arabia, ZATCA Phase 2 is mandatory.

- Choose a Trusted Vendor

- Look for regional experience, compliance features, and local support.

- Run a Pilot Test

- Start with a small set of invoices.

- Check accuracy, timing, and approval flows.

- Train Your Team

- Educate staff on features and processes.

- Set up escalation paths for errors or rejections.

Top B2B Invoicing Platforms (and Their Pros/Cons)

| Platform | Pros | Cons |

| Singleclic | ZATCA-ready, regional support, custom API build | Only available in select markets |

| Zoho Invoice | Easy to use, good for SMEs | Limited tax compliance in GCC |

| QuickBooks | Strong integration with accounting tools | Not fully ZATCA-compliant out of the box |

| SAP Ariba | Enterprise-grade, strong compliance | Expensive, complex setup |

| FreshBooks | Simple UI, good mobile app | Basic features not ideal for large B2B use |

FAQ: B2B Invoicing

Q: Is e-invoicing the same as emailing a PDF invoice?

A: No. True e-invoicing uses structured formats (like XML) and often connects to government tax systems.

Q: What is ZATCA and why does it matter?

A: ZATCA is Saudi Arabia’s tax authority. Businesses must comply with their e-invoicing regulations or face penalties.

Q: How long does it take to switch to a digital system?

A: It depends on your setup, but with the right partner, you can go live within 2 to 6 weeks.

Q: Can B2B invoicing tools handle international clients?

A: Yes, most platforms support multiple currencies and tax rules. Just make sure your provider includes that.

Q: Is digital invoicing safe?

A: Yes, if your provider offers encryption, access controls, and audit logs. Always check for certifications like ISO 27001.

Final Takeaway

B2B invoicing is more than just sending bills. It’s a system that affects cash flow, compliance, and trust between companies. Doing it right saves time, prevents penalties, and speeds up payments.

With rising regional mandates like ZATCA, digital invoicing isn’t optional—it’s essential.

Singleclic provides a tailored, compliant, and human-friendly invoicing solution backed by expert support.

“B2B invoicing used to be a pain point. Now, it can be your strength—if you use the right tools,” says Tamer Badr.