Robotic Process Automation (RPA) has shifted from niche back‑office pilot to board‑level imperative across banks, insurers, wealth managers, and fintechs. Analysts peg the RPA market in financial services at US $3.79 billion in 2024, with a forecast CAGR of 43.9 % through 2030. Faced with margin pressure, growing compliance costs, and digital‑first competitors, institutions are turning to software robots to accelerate routine work, cut errors, and free employees for advisory roles.

“RPA is the fastest path to visible efficiency wins in finance,” says Tamer Badr, owner of Singleclic. “Automate the reconciliations, loan checks, and KYC chores—and let your people focus on insight and customer trust.”

People Are Always Asking …

Financial executives often pose five recurring questions:

- Where do we start?

Begin with high‑volume, rule‑based tasks—invoice matching, account reconciliation, or customer onboarding—then scale. - How soon is ROI?

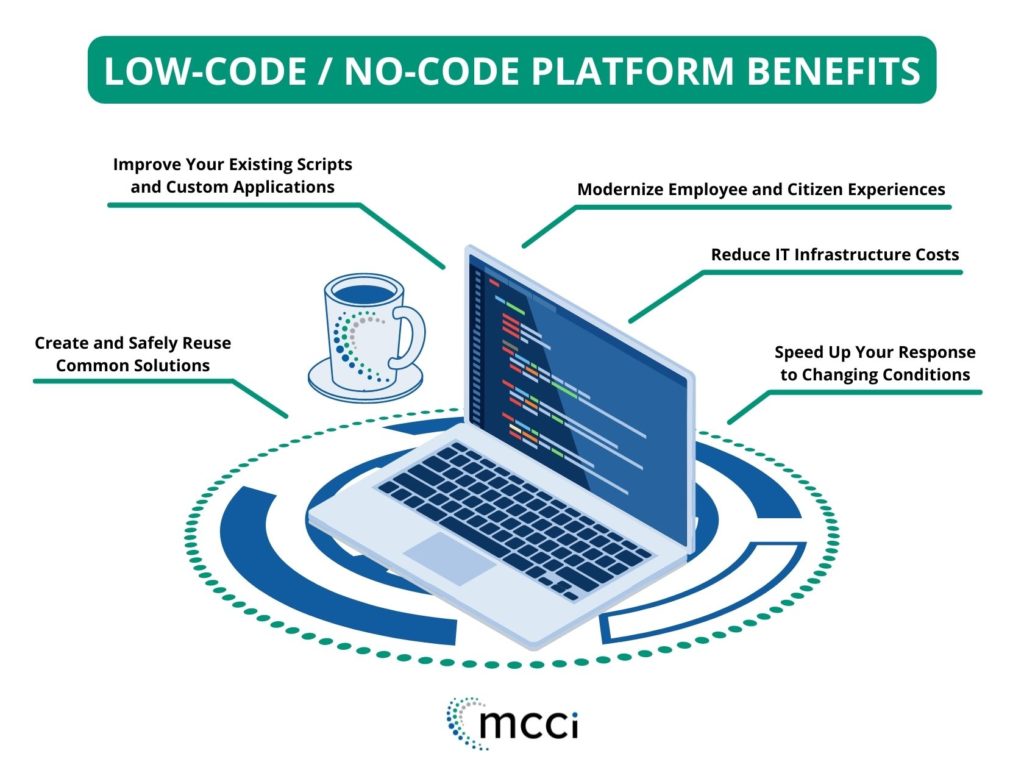

Pilot bots typically pay back within 6–9 months, driven by 50 % faster cycle times and error reductions. - Do we need coding skills?

Modern low‑code studios let analysts drag‑and‑drop workflows; IT governs security and releases. - Will bots replace staff?

Most institutions redeploy talent toward analytics and advice; Deloitte notes only 17 % encounter notable resistance, dropping to 3 % post scale‑up. - Cloud or on‑prem?

Both thrive. Cloud RPA accelerates setup; some regulated firms keep sensitive bots on‑site for data residency.

Why RPA Matters in Finance

- Rising Transaction Volumes – Instant payments and open banking multiply data entry.

- Regulatory Burden – AML, FATCA, GDPR, and ESG reporting demand perfect audit trails.

- Margin Compression – Low interest rates push banks to shave operating costs up to 30 %.

- Customer Expectations – Users expect 24/7 digital service; bots deliver round‑the‑clock accuracy.

A Baker Tilly survey shows 82 % of financial institutions now run RPA in at least one core process.

Signature RPA Use Cases in Financial Services

| Domain | High‑Impact Applications | Business Outcome |

| Retail & Commercial Banking | Know‑Your‑Customer checks, loan origination, account closure automation | Onboarding time ↓ 70 %, compliance fines avoided |

| Capital Markets | Trade settlement, corporate action processing, margin calls | Straight‑through‑processing ↑, break resolution hours ↓ |

| Insurance | Claims triage, policy issuance, endorsements | Claims cycle time ↓ 30 %, customer NPS ↑ |

| Wealth & Asset Management | Portfolio reconciliation, fee calculations, client reporting | Manual effort ↓ 60 %, report turnaround from days to minutes |

| Finance & Treasury | GL reconciliations, inter‑company netting, liquidity monitoring | Month‑end close accelerated by four days |

Ten Concrete Examples

- Invoice‑to‑Pay Automation – Robots extract PDF data, validate against PO, post to ERP, and trigger payment approval.

- Real‑Time Fraud Screening – Bots query sanctions lists and flag suspicious payments within milliseconds.

- Credit Card Dispute Handling – RPA gathers transaction evidence, populates case files, and communicates with networks automatically.

- Customer Name Screening – Robots cross‑check new accounts against OFAC/PEP lists, reducing manual workload by 80 %.

- Mortgage Processing – Bots scrape e‑statements, fill underwriting forms, and upload documents, cutting days off approval.

- Reconciliation of SWIFT MT Messages – Automated matching with core‑bank data slashes overnight breaks.

- Insurance FNOL (First Notice of Loss) – Bots pull policy data, create claim shells, and schedule assessor visits.

- Regulatory Reporting – Robots collate Basel III liquidity metrics and file XBRL before deadlines.

- Treasury Cash Positioning – RPA aggregates balances across 50 + banks, producing 9 a.m. cash dashboards daily.

- Corporate Action Capture – Bots read custodial notices, update security masters, and notify traders instantly.

Quantifying the Benefits

- Cost Reduction – A Deloitte case shows a global bank saving US $40 million over three years after deploying 150 bots to process 120 000 requests per week at 30 % the human cost.

- Accuracy – AIMultiple notes 85 % of firms report RPA exceeds expectations in accuracy and timeliness.

- Speed – Loan processing drops from days to minutes; trade breaks clear before markets open.

- Compliance – Bots execute every control step, generating immutable audit logs that simplify regulator exams.

- Scalability – Digital workers spin up instantly for quarter‑end peaks, then scale down—unlike contractors.

- Employee Morale – Analysts freed from data rekeying pivot to client analytics, boosting retention.

Tamer Badr adds: “One Egyptian bank cut card‑dispute backlogs by 90 % in a quarter—customers got refunds faster, staff shifted to cross‑selling.”

Potential Drawbacks & Risk Mitigation

| Pitfall | Impact | Recommended Fix |

| Automating bad processes | Faster chaos, hidden control gaps | Run Lean/Six Sigma mapping first |

| Bot Sprawl | Hundreds of scripts with no ownership | Create RPA Center of Excellence, enforce version control |

| UI Fragility | Minor screen changes break robots | Use resilient selectors, API hooks where possible |

| License Cost Creep | Per‑bot and orchestrator fees escalate | Track utilization, retire low‑value bots, negotiate bundles |

| Security Holes | Hard‑coded creds or broad privileges | Vault secrets, apply least‑privilege, audit quarterly |

| Change Resistance | Staff fear job loss | Transparent communication, re‑skill plan, celebrate wins |

Gartner stresses that 90 % of RPA vendors will embed generative‑AI features by 2025 —driving both opportunity and new governance needs.

Implementation Best Practices

- Baseline KPIs – quantify cycle time, FTE, error rates.

- Establish Governance – RPA CoE sets standards, security, and ROI gates.

- Pick a Pilot – high‑volume, rule‑based, low‑exception process.

- Engage SMEs – map step‑by‑step tasks, validate exceptions.

- Design for Scale – modular scripts, reusable components, secure credential vault.

- Run Parallel – shadow human process until accuracy ≥ 98 %.

- Measure & Optimize – feed dashboards; use process mining to find new targets.

- Expand with AI – add OCR, NLP, or ML to tackle semi‑structured data.

Real‑World Voices

Aisha H., Head of Ops, MENA Universal Bank

“KYC automation cut onboarding from seven days to 24 hours. Yes, we spent months cleansing data, but regulator feedback was glowing.”

Miguel S., CFO, Latin American Insurer

“Bots process 10 000 claims nightly; customers see payout status by breakfast. Our NPS jumped six points.”

Lars K., Treasury Lead, Nordic Asset Manager

“Cash‑position robots save my team two hours every morning. Traders make faster funding decisions—and we avoided an overdraft fee that alone paid for the project.”

Frequently Asked Questions (FAQ)

- What KPIs signal a good automation candidate?

- High volume, repeat frequency, rule clarity, error pain, manual effort hours.

- How many bots per analyst can we manage?

- Mature teams oversee 20–30 unattended bots per analyst when dashboards and alerts are in place.

- Can RPA coexist with core‑system upgrades?

- Yes. Use API connectors where available; schedule bot updates alongside release cycles.

- What skills should an RPA developer have?

- Process logic, low‑code tool expertise, regex & SQL basics, and security best practices.

- How do we price RPA vendors?

- Evaluate per‑bot vs. concurrent‑run models, orchestrator tiers, AI add‑ons, and support SLAs.

Future Trends Driving RPA in Finance

- Hyper‑Automation Suites – Orchestrating RPA with AI, iPaaS, and process mining for end‑to‑end straight‑through flow.

- Generative‑AI Assistants – Natural‑language bot building, auto‑documentation, and exception handling chat.

- Self‑Healing Robots – AI detects UI changes, adjusts selectors without human touch.

- Embedded ESG Reporting – Bots compile scope‑3 emissions and EU taxonomy data for green‑bond issuers.

- Real‑Time Payments (RTP) – 24/7 instant‑payment bots reconcile in seconds, preventing fraud.

- Risk‑Averse Clouds – Financial‑grade SaaS RPA with data‑locality controls for cross‑border banks.

Conclusion: Positive Momentum for RPA in Finance

RPA has proven its mettle—cutting costs, slashing errors, and unleashing staff on higher‑value work. With market growth surging and AI features maturing, financial services leaders who institutionalize RPA now will gain durable competitive advantage.

Tamer Badr sums up: “Treat robots as digital teammates. Nurture them with governance and data hygiene, and they’ll reward you with speed, savings, and satisfied customers.”

References

- Baker Tilly – State of RPA in Financial Institutions 2024 bakertilly.com

- AIMultiple – 50 RPA Statistics (2025 update) research.aimultiple.com

- Deloitte – Global Bank Saves $40 M with 150 Bots www2.deloitte.com

- Gartner – Finance RPA Impact & Trends gartner.com

- AutomationEdge – RPA in Banking: Market $1.12 B by 2025 automationedge.com

- Flobotics – Global RPA Market $22.79 B in 2024 flobotics.io

- CoinLaw – RPA Finance Market Projection coinlaw.io

- Baker Tilly – RPA Reshaping Financial Processes bakertilly.com

- Gartner MQ – 90 % of RPA Vendors to Embed Gen‑AI by 2025 cxtoday.com

By taking a strategic, governance‑first approach, institutions can harness RPA in financial services to amplify efficiency today—and pave the way for the intelligent, hyper‑automated bank of tomorrow.